Personal Budget Excel Template

Description

Managing your finances efficiently is essential for achieving long-term stability and reaching your financial goals.

Our Personal Budget Planner Excel Template is expertly designed to make budgeting simple, logical, and stress-free, whether you’re an individual, a couple, or managing finances for your entire family. With user-friendly formatting, interactive built-in charts, and organized categories, this template streamlines the process of tracking your income, expenses, and savings month-by-month.

Comprehensive Financial Management in One Place

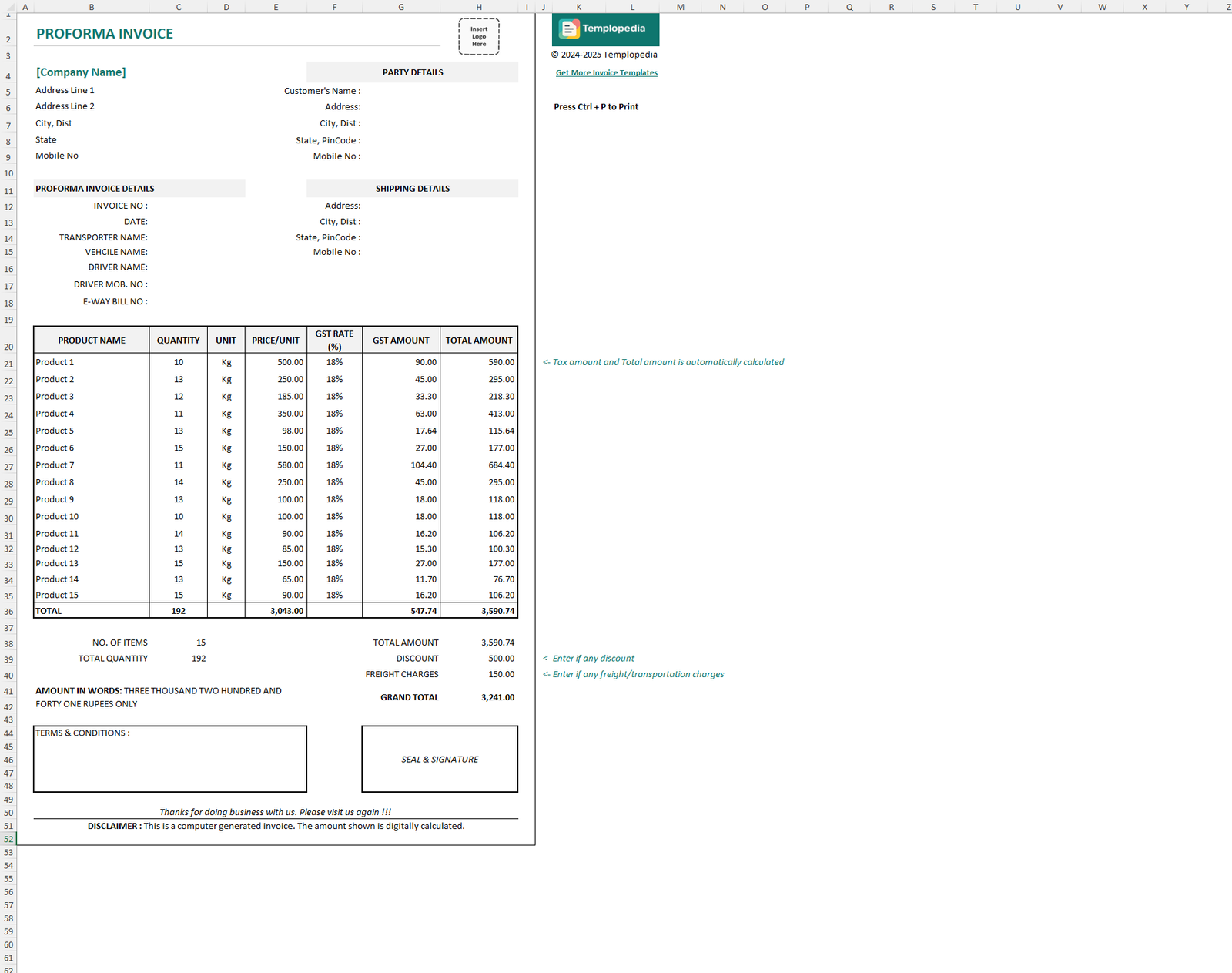

- The Personal Budget Planner Excel Template enables you to consolidate all your financial details in a single, easy-to-read spreadsheet. The layout is intuitively separated into major sections: Income, Expenses, a Monthly Summary, and handy Charts.

- Enter your starting balance, list your different income sources—such as salary, freelance earnings, business income, or side hustles—and record all your expenses across customizable categories like Housing, Groceries, Utilities, Transportation, Entertainment, Insurance, Health, Savings, and Miscellaneous.

This easily accessible format ensures that nothing slips through the cracks and gives you a complete overview each month.

Empower Your Decision-Making with Visual Insights

- One of the standout features of this Excel budget planner is its ability to provide instant graphical summaries of your financial data. As you enter and update your information, the template automatically generates colorful, easy-to-understand charts and graphs.

- These visual tools help you quickly spot trends such as rising expenses or unexpected savings surges, empowering you to make timely adjustments to your spending habits. See instantly where your money goes each month, identify areas where you can cut back, and set more effective, realistic savings goals.

Simple & Flexible to Use—No Financial Expertise Required

From a beginner to expert, the template can be used easily. Step-by-step instructions guide you from setup to regular use:

Achieve Your Financial Goals—One Month at a Time

With this budget planner, you gain the structure and clarity needed to stick to your budget and steadily improve your financial health. Whether you want to save for a big purchase, pay off debt, build an emergency fund, or simply gain better control over your day-to-day finances, the Personal Budget Planner Excel Template offers a solid foundation.

Unlike generic apps, it’s fully customizable to fit your individual needs and can be updated over time as your circumstances change.

Who Can Benefit from This Template?

This tool is perfect for anyone seeking better financial organization—students, working professionals, freelancers, families, or retirees. It’s also a smart choice for those new to budgeting, as the clear structure encourages consistency, while the visual feedback keeps motivation high.

Take the First Step towards Financial Wellness

Our free Personal Budget Planner Excel Template transforms budgeting from a chore into a rewarding financial habit.

Start today and experience the peace of mind that comes from understanding and controlling your money—month after month. Download the template, follow the easy steps, and put yourself on the path to a brighter financial future!

How to Use

How to Use the Personal Budget Planner Excel Template: Complete Guide

Take control of your finances with our intuitive Personal Budget Planner Excel Template. Here’s how to make the most of every feature for effective monthly budgeting:

- Set Your Financial Starting Point

At the very top of the template, enter your starting balance. This will serve as your financial baseline and make all calculations and summaries accurate for the current month. - Customize the Starting Month

By default, the month may be labeled "Jan." If you want your budgeting to start from a different month—such as "Mar"—simply change the month label in the first table. Then, drag this selection towards the right; all connected tables throughout the spreadsheet will update automatically, ensuring consistent month names across your budget. - List All Income Sources

In the “INCOME” section, record each source of income you have for that month, such as salary, business income, freelance payments, or side jobs. - Record Expenses by Category

Document your monthly expenses by entering them under their relevant categories (e.g., Housing, Groceries, Utilities, Transportation, Insurance, Health, Entertainment, Savings, and Miscellaneous). - Add More Detail as Required

You can list up to 10 items under each category by default. If you need more space, simply insert new rows above the "Total" row within that category and make sure you update the summary formula to include these additional rows. - Review the Automated Summary

The template will automatically calculate total income, total expenses, and your net profit or loss for the month. This summary provides at-a-glance insight into your overall financial standing. - Visualize Trends with Built-In Charts

Instantly see how your finances are performing using the automatically updating charts. These visuals allow you to monitor trends in spending, income, and savings—empowering you to make better decisions. - Adjust and Refine Your Budget Each Month

At the end of every month, review and update your income and expense entries. Use the summary and charts to identify areas for improvement, cut unnecessary costs, or boost your savings. Refine your plan to match changing goals or circumstances. - Customize and Expand as Needed

The template is fully customizable. If your categories or items expand, simply add new lines in your preferred sections and update the total formulas to keep calculations accurate.

By following these straightforward steps, you'll maximize the effectiveness of your budget, stay organized, and work flexibly towards your financial goals—all with the convenience and clarity of our Excel budget planner.

Comments

No comments yet. Be the first to comment!

Related Templates

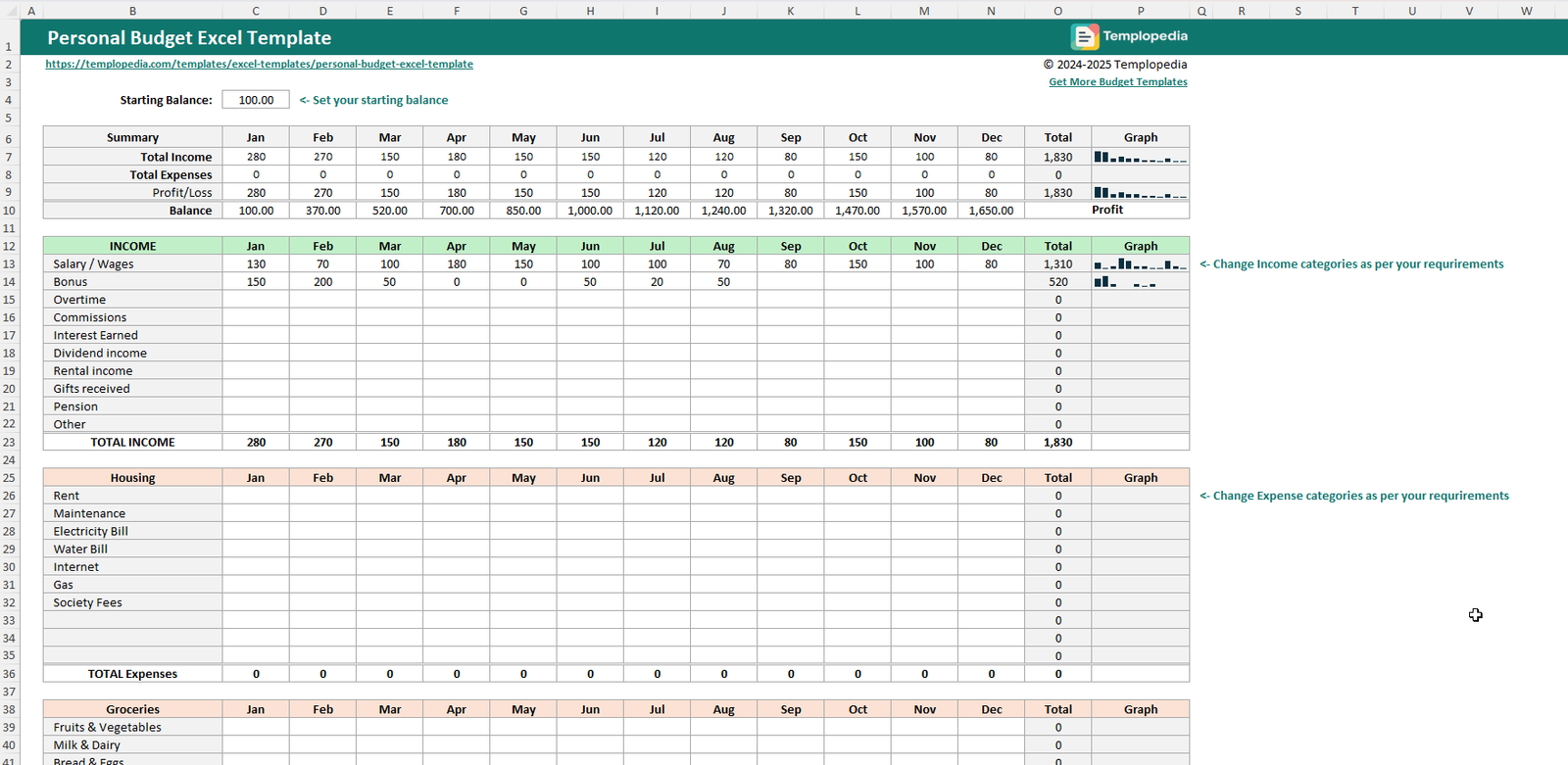

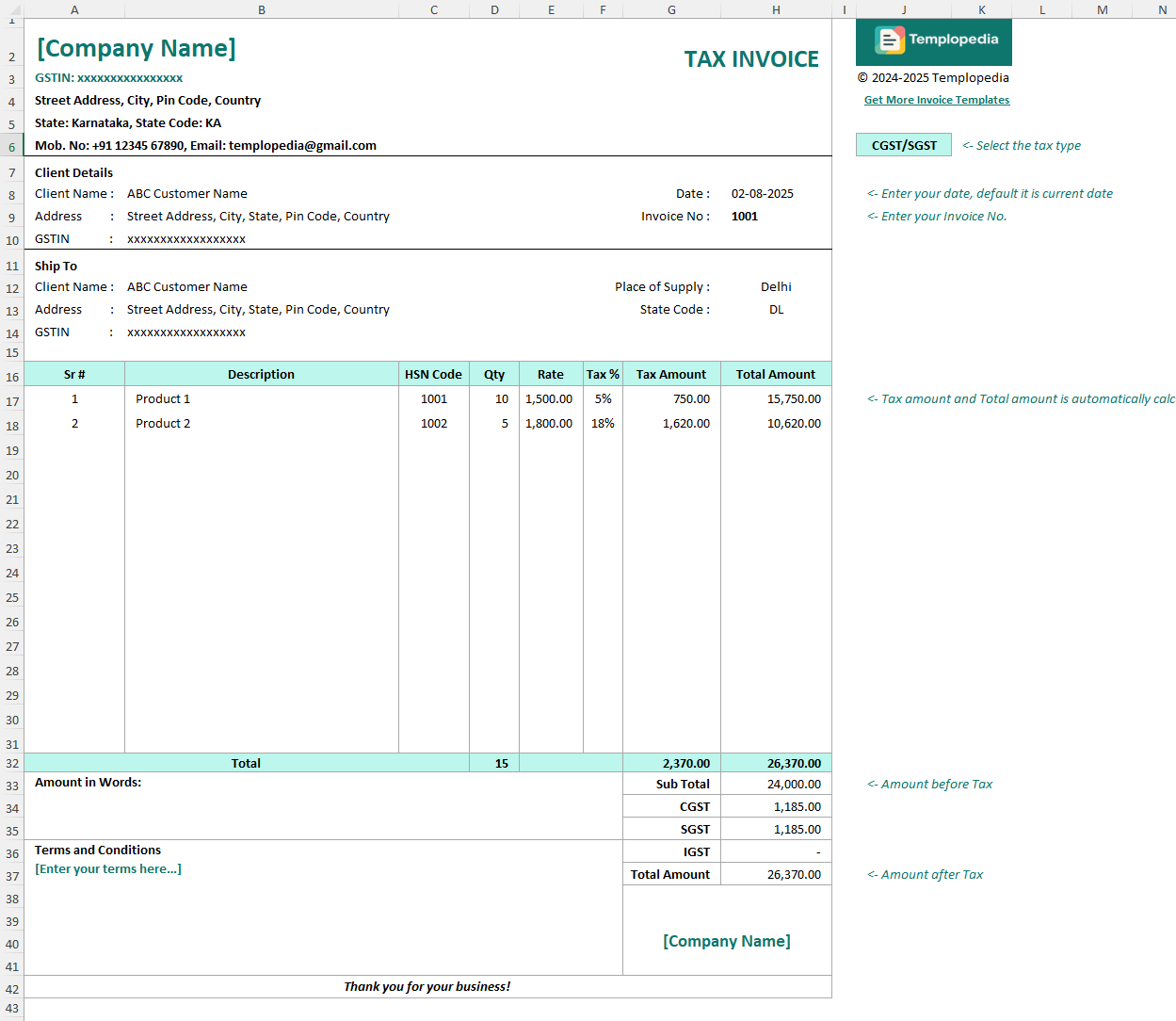

Free GST Invoice Template in Excel

696 downloads

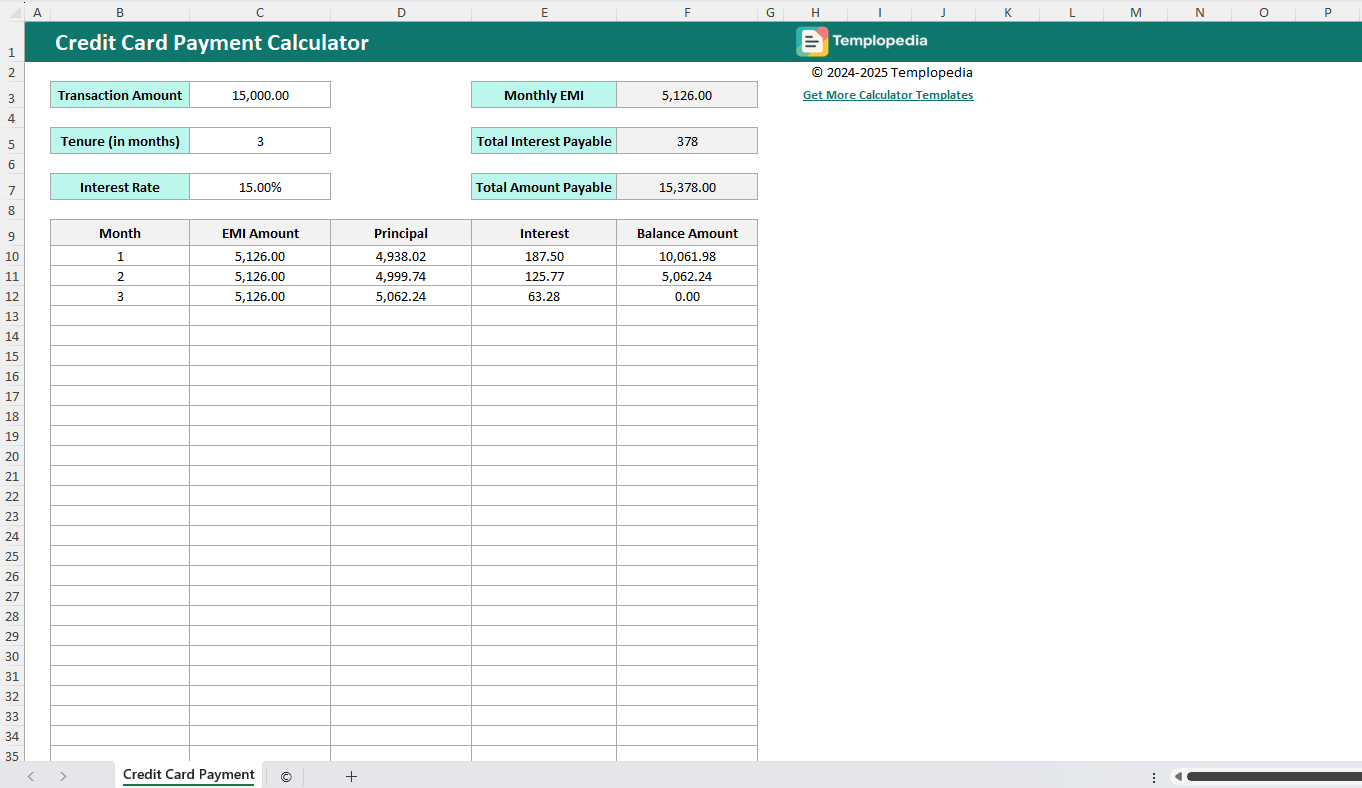

Credit Card Payment Calculator

28 downloads

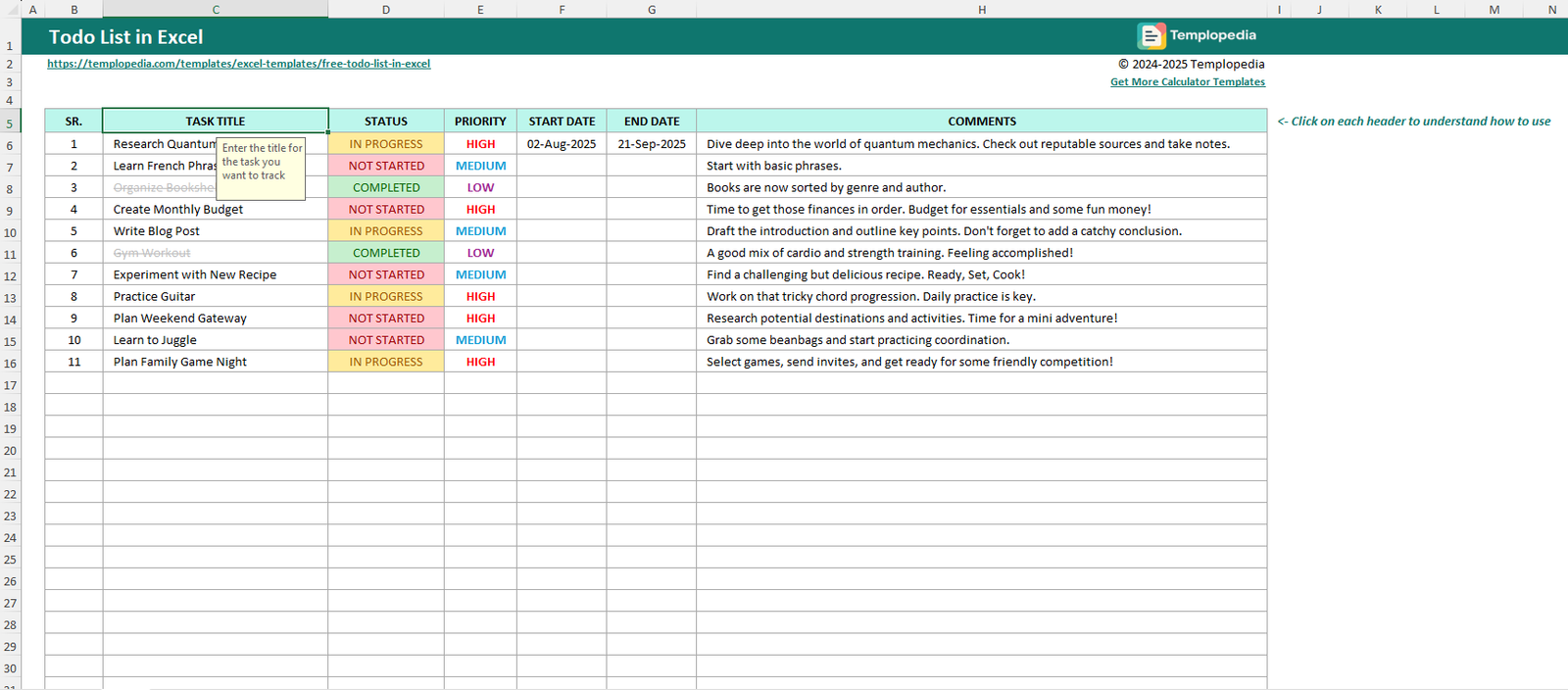

Free ToDo List in Excel

1492 downloads