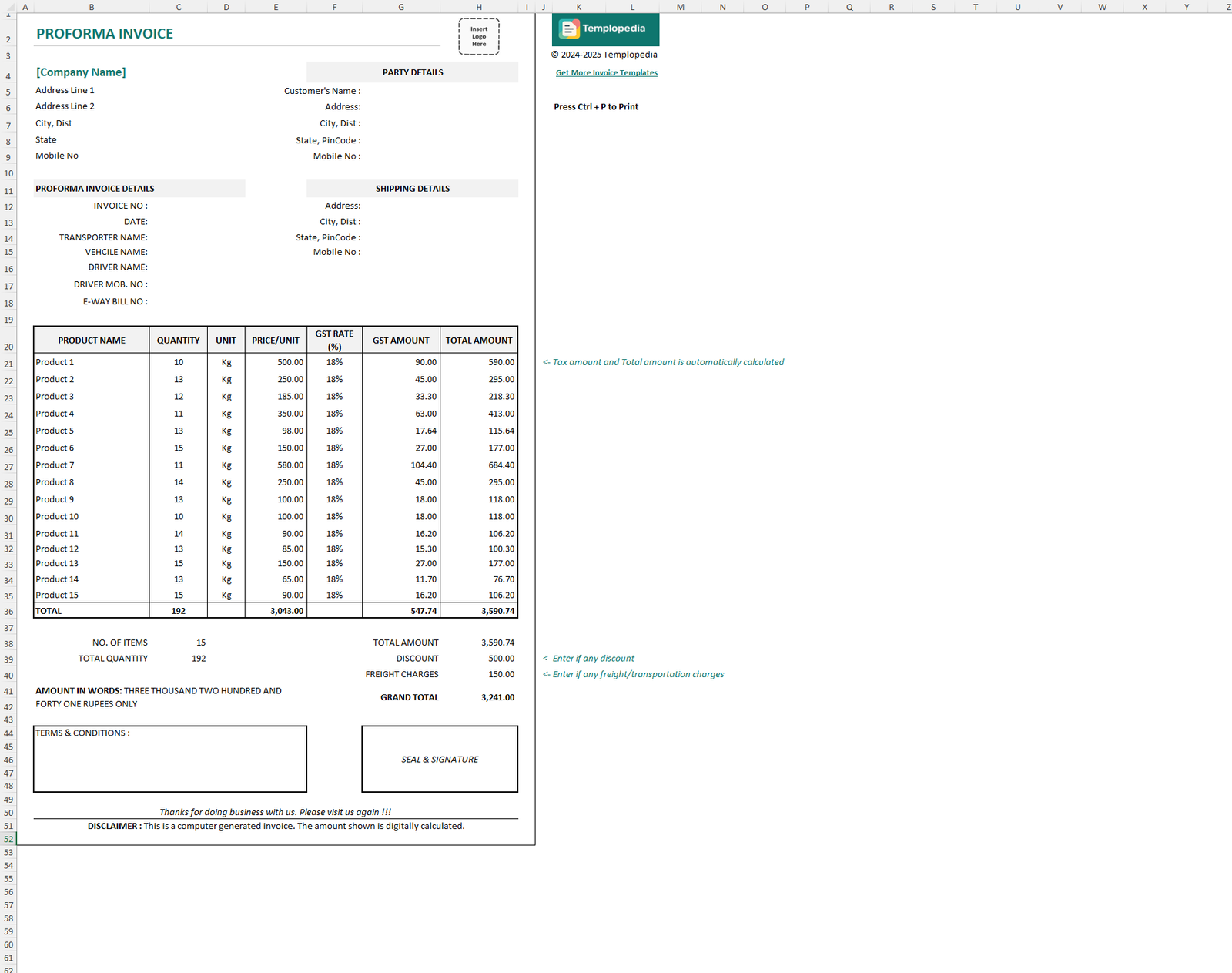

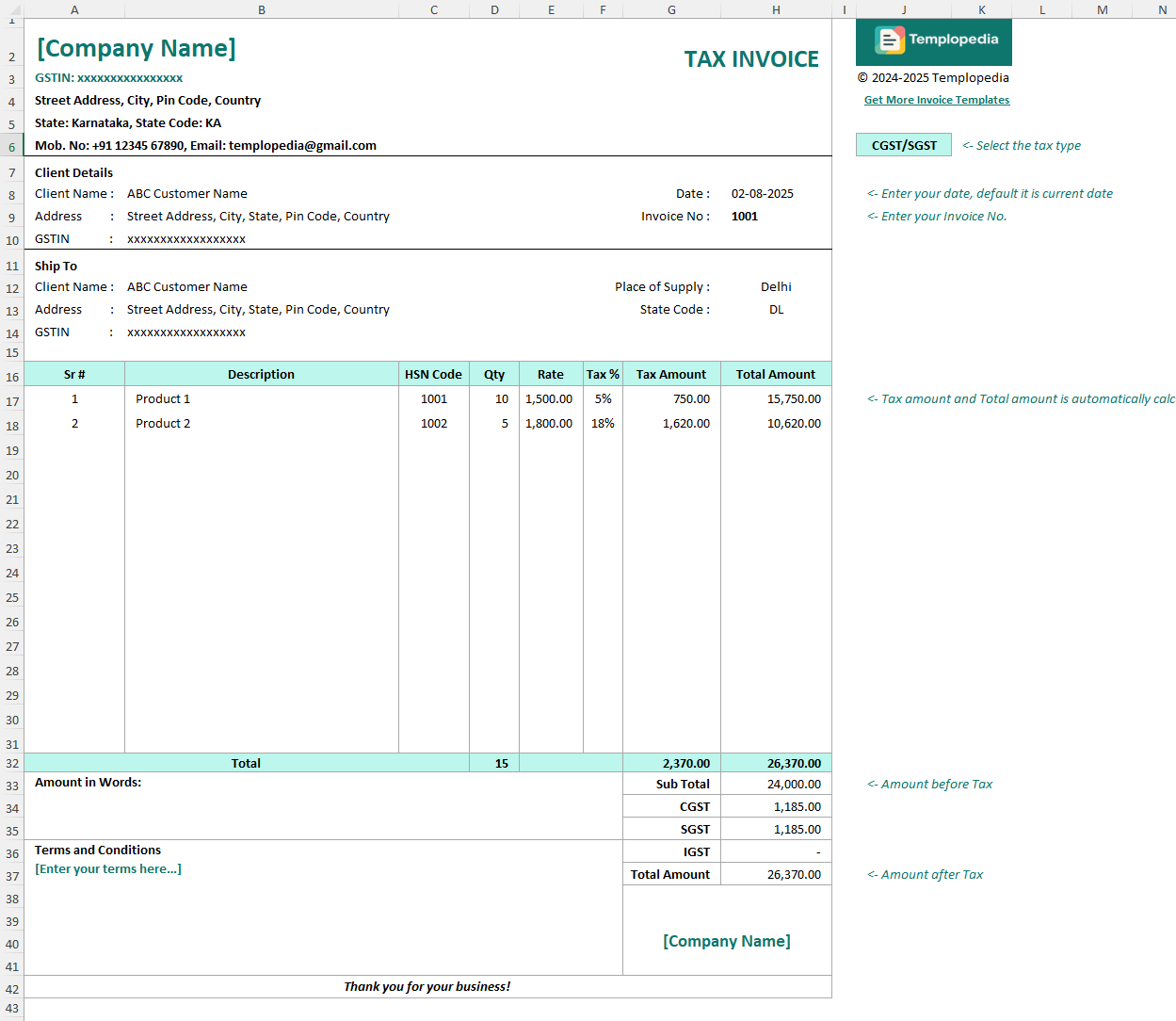

Free GST Invoice Template in Excel

Description

Simplify your business billing process with our Free GST Invoice Excel Template, designed especially for Indian businesses, freelancers, retailers, service providers, and accountants. This Excel-based GST billing solution is perfect for generating clean, professional, and fully GST-compliant invoices without any complex software.

Whether you issue a single invoice per month or batch-bill multiple clients, this free GST invoice in Excel ensures accuracy, transparency, and fast payment processing. No subscriptions, no watermarks – just a clutter-free, print-ready template built for simplicity and compliance.

✅ Key Features of Our Free GST Invoice Excel Template

- The invoice is in fully GST-Ready Format with automated tax calculations

- Pre-built fields for GSTIN, HSN/SAC codes, quantity, rate, and tax

- Auto-calculation of product/service-wise tax amounts and total invoice value

- Covers both intra-state and inter-state supply with dynamic tax logic

- Discount-ready fields with subtotal and total adjustments

- Print-friendly layout and PDF-export capability

- Fully editable and brandable—add your logo, color scheme, or digital signature

- Mobile-compatible format for editing on the go

- Works 100% offline—no internet or software installation required

👥 Who Should Use This Free GST Invoice in Excel?

- Retailers and Wholesalers

- Freelancers and Consultants

- Service Providers and Small Agencies

- Chartered Accountants and Tax Professionals

- MSMEs and Startups billing GST-registered clients

This free GST invoice Excel template helps ensure complete compliance with Indian GST regulations while saving time and preventing billing errors.

How to Use

1. Download and Open the Template

Start by downloading the Excel template to your local system. Open the .xlsx file using Microsoft Excel or any compatible spreadsheet application such as Google Sheets or LibreOffice Calc. No macros or plugins are needed — the sheet is fully functional on its own.

2. Enter Seller and Buyer Information

- Update the seller details in the top section:

- Your business name (as per GST registration)

- Address, contact number, and email

- Registered GSTIN (15-digit GST number)

Enter the buyer’s information in the respective section:

- Client’s legal name and billing address

- Their GSTIN (if applicable)

- Place of Supply

- Ensure that both GSTINs are correct to avoid mismatch issues during GSTR filing.

3. Select Tax Type and Supply Type

- The template uses the "Place of Supply" field to automatically decide whether to apply:

- CGST + SGST for intra-state transactions (same state)

- IGST for inter-state transactions (different states)

- You can manually toggle the tax type if needed. The tax amount adjusts automatically based on the selection and applicable GST rates.

4. Add Invoice Metadata

In the invoice header, enter:

- Unique Invoice Number

- Invoice Date

5. Itemize Products or Services Sold

List each line item with the following details:

- Serial Number

- Product/Service Description

- HSN/SAC Code

- Quantity

- Rate per Unit (excluding GST)

- Applicable GST Rate (e.g., 5%, 12%, 18%, etc.)

The sheet will automatically:

- Calculate the taxable value for each line item

- Show the Tax Amount and Total Amount automatically

- Sub Total, CGST, SGST and IGST along with Total Amount are auto calculated

6. Enter Final Details and Save Invoice

- At the bottom:

- Enter Amount in Words (for legal clarity)

- Add any Terms & Conditions, payment instructions, or bank details

- Add your signature or digital stamp if needed

Once done:

- Press Ctrl + P to print the invoice

- Or use Save As > PDF to generate a digital invoice you can email or share on WhatsApp

Comments

No comments yet. Be the first to comment!

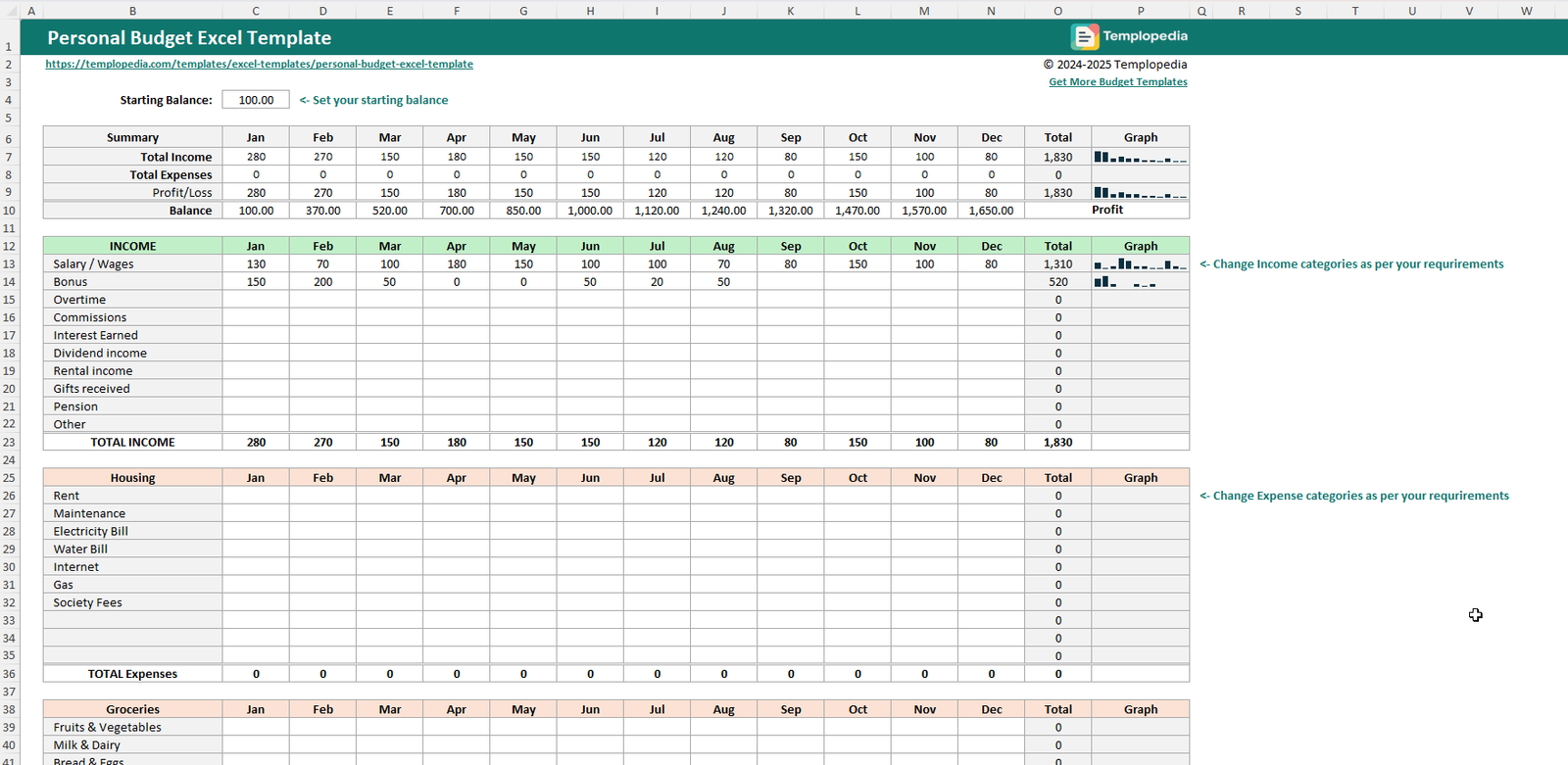

Related Templates

Personal Budget Excel Template

791 downloads

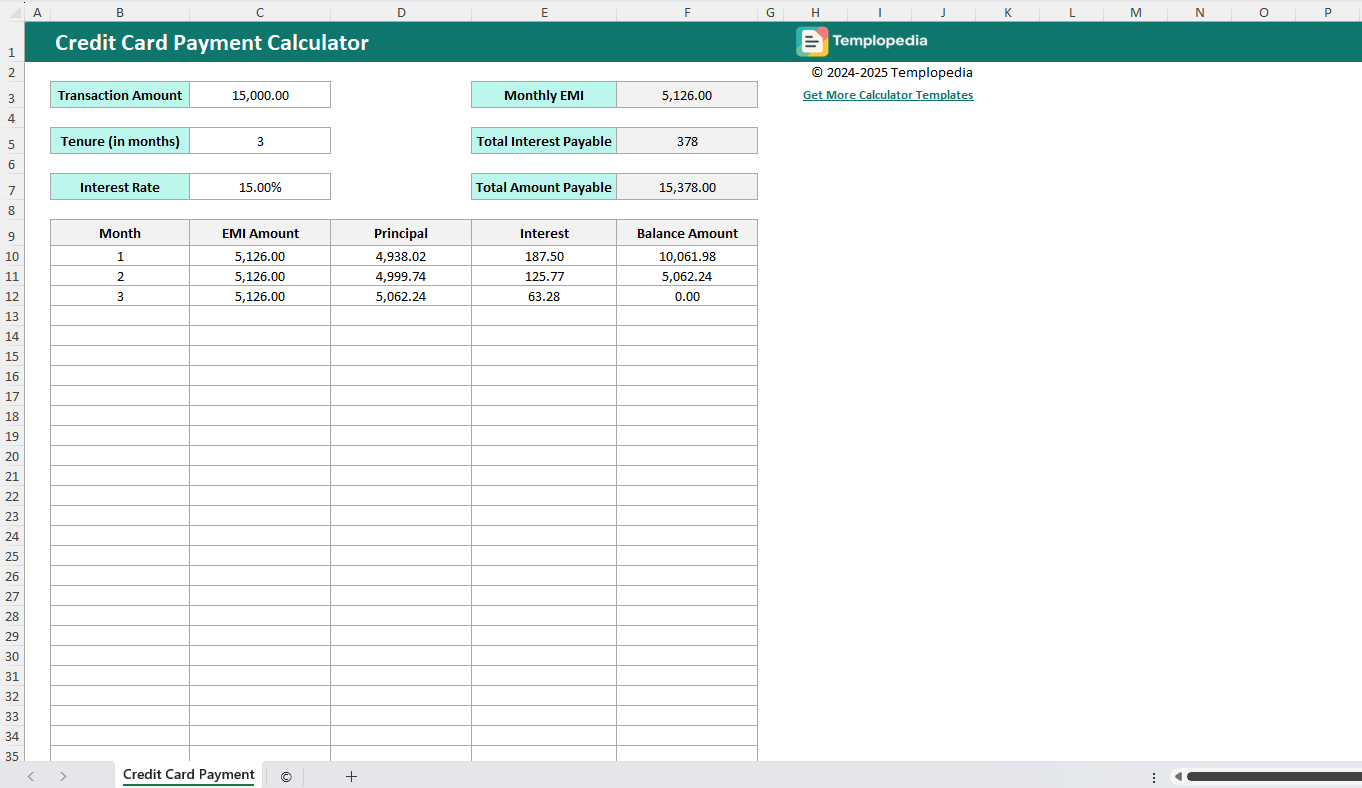

Credit Card Payment Calculator

28 downloads

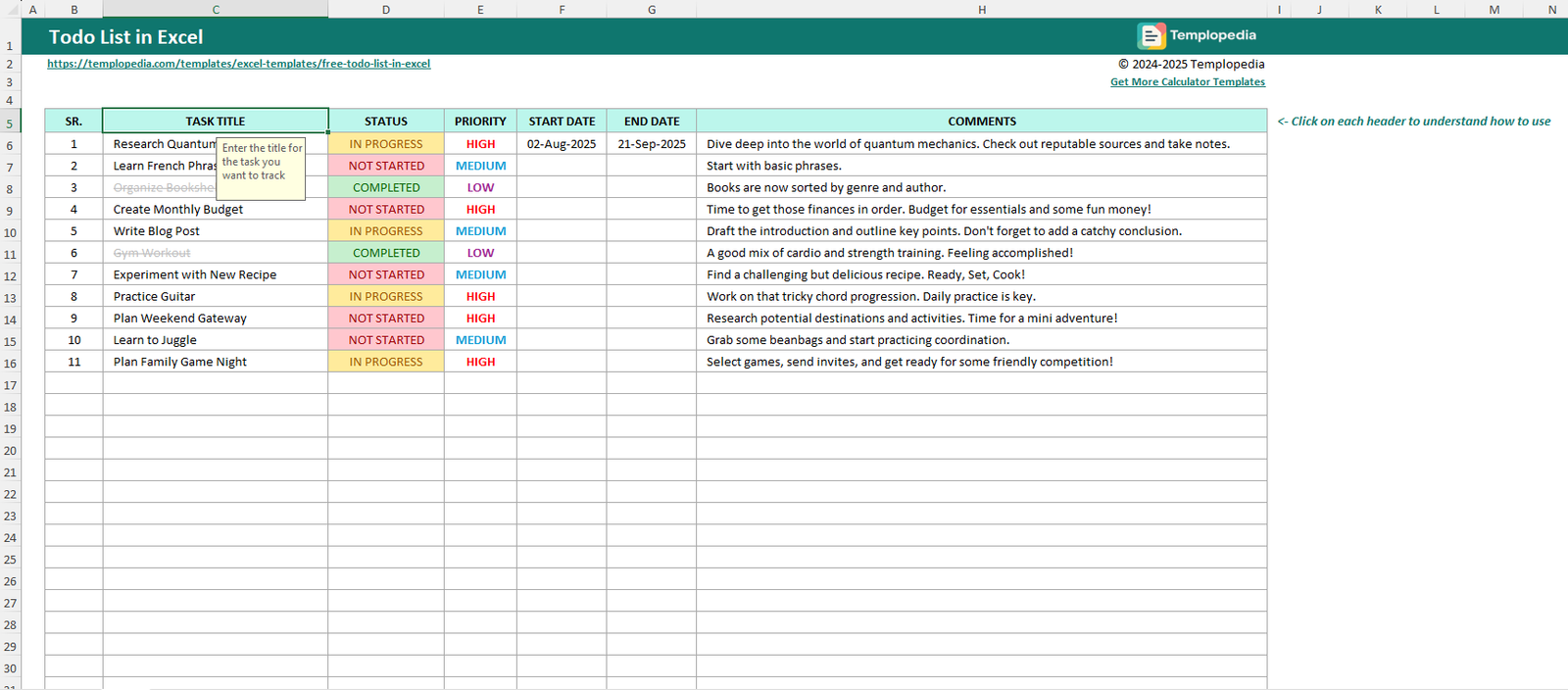

Free ToDo List in Excel

1491 downloads