Credit Card Payment Calculator

Description

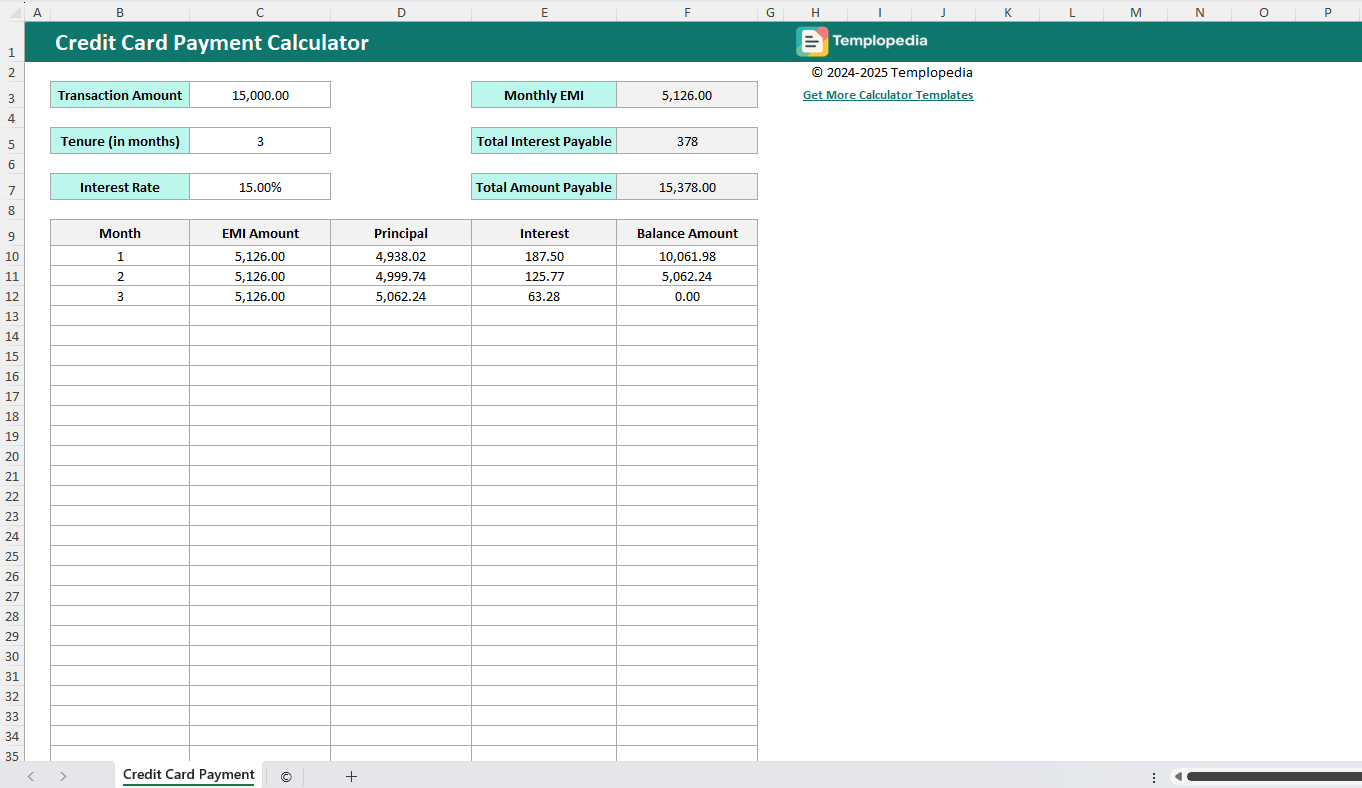

Take control of your credit card payments with this easy-to-use Credit Card Payment Calculator Excel Template. Designed for both personal and business use, this template helps you efficiently calculate and plan your monthly EMI (Equated Monthly Installment) payments, total interest costs, and outstanding balance for your credit card transactions. Whether you're planning a big purchase or aiming to reduce your credit card debt, this calculator provides you with clear insights and helps you make informed financial decisions.

Key features include:

- Automated EMI calculation based on transaction amount, interest rate, and tenure.

- Breakdown of principal and interest for each payment month.

- Track outstanding balance after every installment.

- Immediate overview of your total interest payable and total amount payable.

- Simple, user-friendly design for quick and easy calculations.

Perfect for individuals, families, accountants, and businesses, this Credit Card Payment Calculator Excel template simplifies credit card management, keeps you on top of your payments, and helps you avoid costly interest charges.

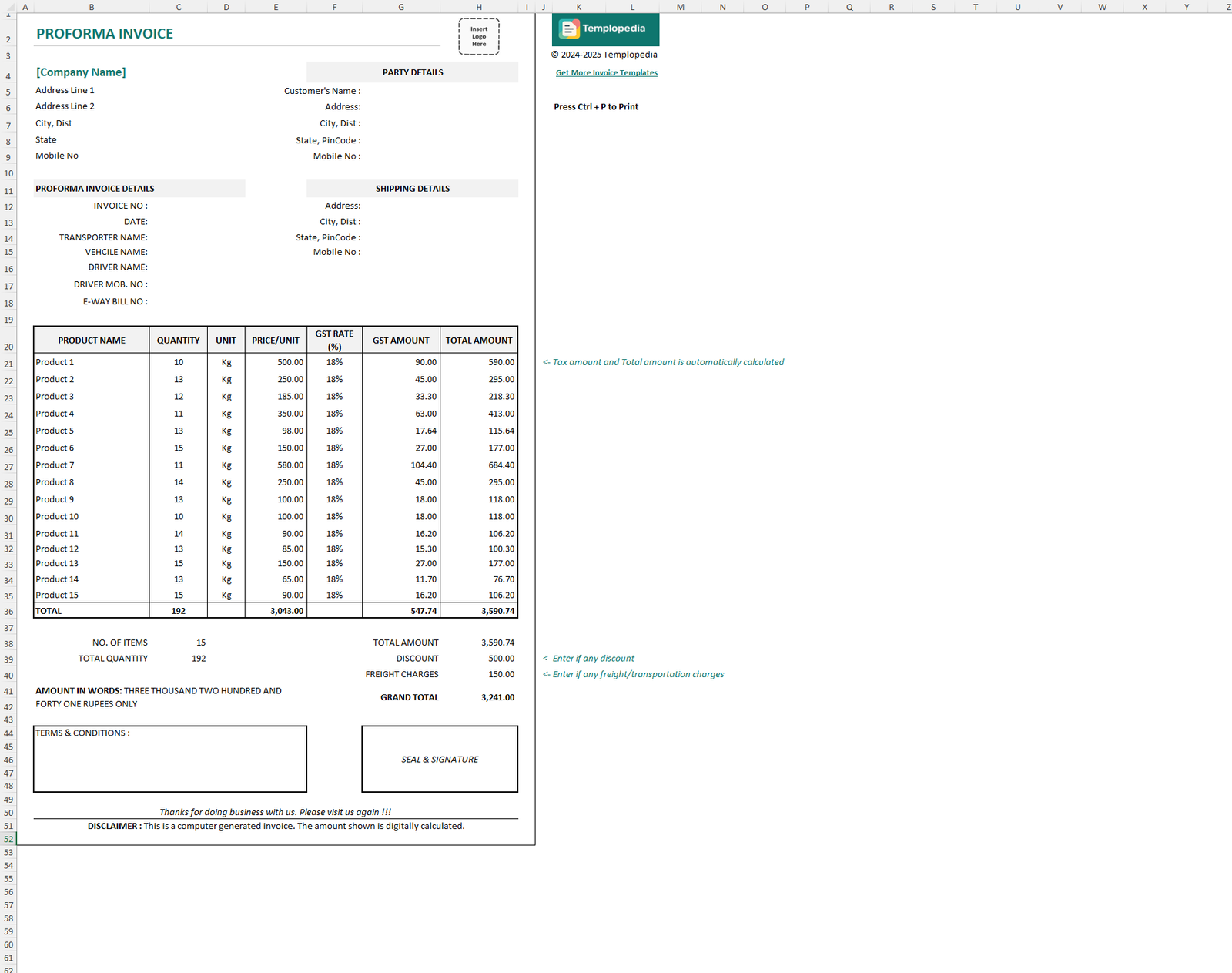

How to Use

Step 1: Input Basic Details

At the top left section of the template, you’ll find input fields for the key variables:

- Transaction Amount: Enter the total amount charged to your credit card for which you want to calculate the payments.

- Tenure (in months): Input the number of months over which you wish to repay the transaction amount.

- Interest Rate: Enter the applicable annual interest rate (% per annum) for your credit card payment plan.

Step 2: Review Automatic Calculations

The template automatically computes the following based on your inputs:

- Monthly EMI: The fixed amount which you should pay every month to clear your dues within your chosen tenure for the bank.

- Total Interest Payable: The total interest amount you will pay over the entire tenure.

- Total Amount Payable: The sum of the transaction amount and the total interest, representing the full amount to be repaid.

Step 3: Examine the Payment Schedule Table

In the breakdown table (starting from Row 14), each month’s EMI payment is detailed:

- Month: Indicates the payment month.

- EMI Amount: The fixed EMI value for each month.

- Principal: The portion of the EMI payment going towards the original loan amount.

- Interest: The amount of interest paid for that month.

- Balance Amount: The outstanding amount remaining after each EMI payment.

Step 4: Analyze and Plan

- Understand Your Payments: The table allows you to see how much of your payment goes towards interest versus principal each month.

- Manage Your Budget: Use the EMI and total payable figures to plan your monthly finances and ensure you’re prepared for upcoming payments.

- Debt Reduction Insights: Monitoring how your outstanding balance reduces over time can motivate faster repayment and help you minimize interest.

Step 5: Update as Needed

If you need to analyze different scenarios:

- Change the transaction amount, tenure, or interest rate.

- Immediately see how your EMIs and interest costs would change.

Tips for Best Use

- Regularly update the inputs if you make additional payments or change card plans.

- Use this template before making large purchases to understand future financial commitments.

- Download and save a copy for different credit cards if you manage multiple accounts.

Start using this Excel Credit Card Payment Calculator template today to take charge of your finances and avoid hidden costs. Planning your payments is the first step towards financial freedom!

Comments

No comments yet. Be the first to comment!

Related Templates

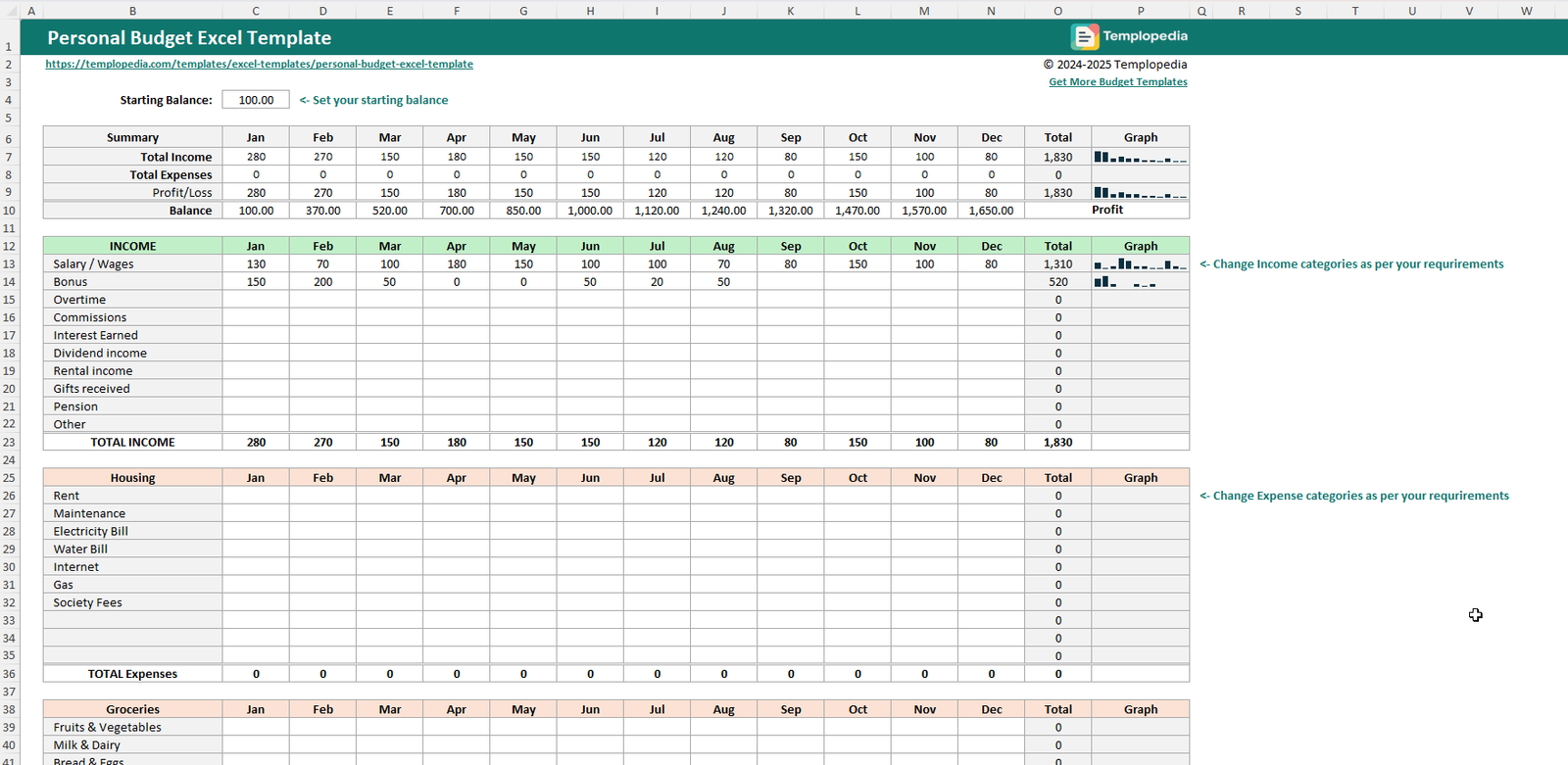

Personal Budget Excel Template

792 downloads

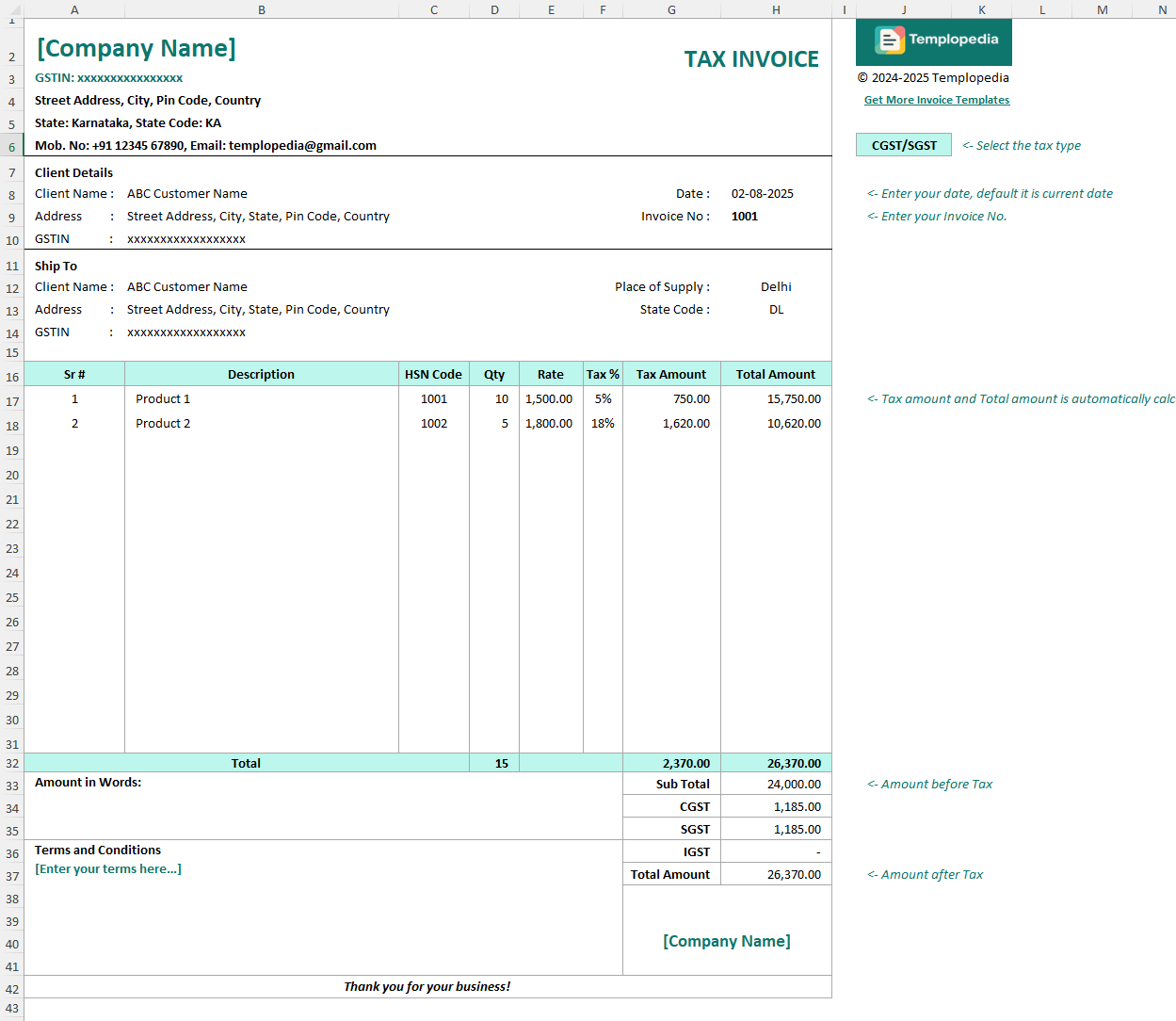

Free GST Invoice Template in Excel

696 downloads

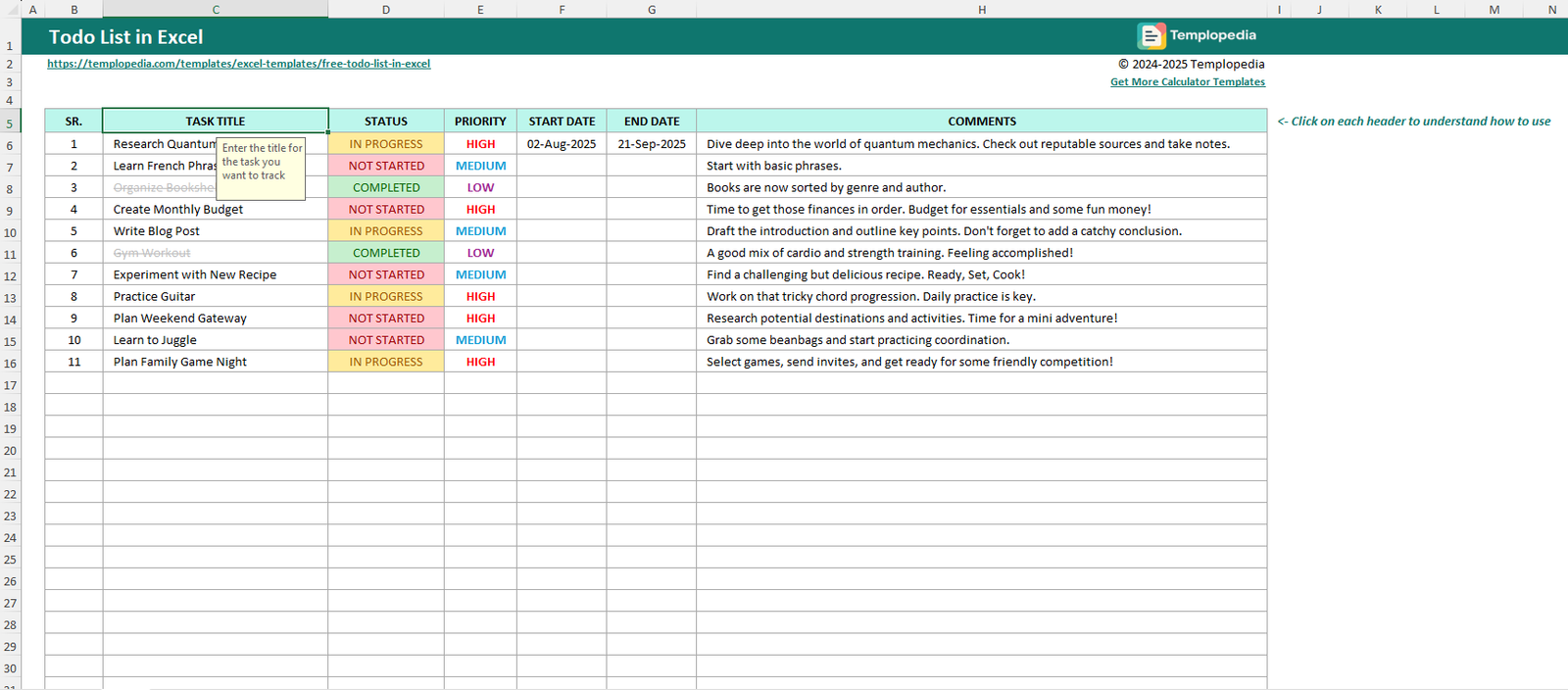

Free ToDo List in Excel

1492 downloads