Free Petty Cashbook in Excel

Description

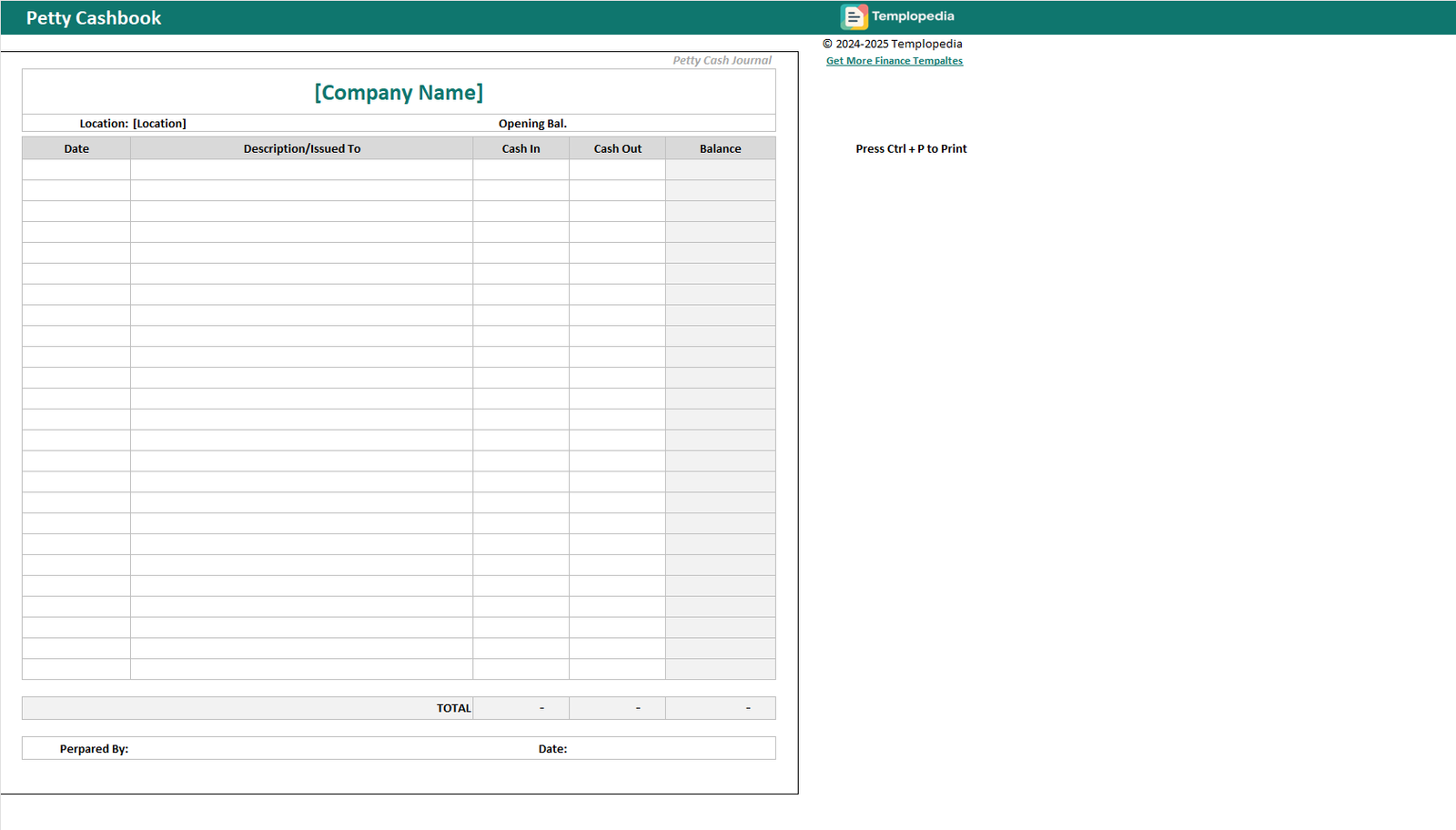

Free Petty Cashbook in Excel: The Essential Offline Tool for Indian Businesses

Every business, big or small, needs a simple method to track small, daily expenses — think courier charges, tea and snacks, local purchases, or any urgent outlays. With the free petty cashbook in Excel, you have a ready-to-use, customizable spreadsheet that makes managing these day-to-day cash transactions effortless and organized.

This Excel petty cash template is perfect for Indian businesses, offices, NGOs, schools, and even families who want a transparent record of cash flow. You don’t need accounting software or an internet connection; just open your Excel, enter your transactions, and monitor your petty cash balance instantly — all offline and free!

Key Features:

- User-Friendly Design: Intuitive columns for Date, Description, Cash In, Cash Out, and Balance.

- Automated Balance Calculation: No manual tallying needed. Excel formulas instantly update your cash position after each entry.

- Flexible and Customizable: Add or modify expense heads as per your business needs.

- Company Branding: Add your company name, location, and customize the format to match your identity.

- Printable and Shareable: Easily print, email as PDF, or share across teams without special software.

Whether you are an accountant, office administrator, or business owner, this free petty cashbook in Excel helps you maintain financial discipline and accurate audit trails for every rupee spent.

How to Use

Step 1: Download the Free Petty Cashbook Excel Template

- Get the free Excel petty cash template from a reliable source.

- You can use it with Microsoft Excel, Google Sheets, WPS Office, or any other compatible spreadsheet app.

Step 2: Enter Company and Cash Details

- In the header, fill your [Company Name], location, and starting (opening) balance for the period.

- This helps you track each location or branch separately if needed.

Step 3: Record Daily Transactions

- Date: Enter the date for each transaction for easy reference and audits.

- Description/Issued To: Note what the cash was spent on (e.g., “Snacks for staff”, “Courier charges”, etc.) or who it was given to.

- Cash In: Enter cash received into the petty cash fund (like a monthly top-up or reimbursement).

- Cash Out: Enter amounts spent or withdrawn.

- Balance: This auto-updates after each transaction, showing your latest cash-on-hand.

Step 4: Monitor and Reconcile

- At any time, check the running balance to avoid cash shortages.

- The total at the bottom gives you an instant summary of all inflows and outflows.

- If the balance is low, you know it’s time to add extra funds to.

Step 5: Customization and Printing

- Add your company logo or change column headings as per your needs.

- Filter by date, type, or recipient for faster analysis.

- Print and file as a physical record, or email as a PDF to your accounts team.

Step 6: Archival and Reuse

- Save a new file for every month or financial period for easy referencing.

- This creates a digital archive, perfect for audits and expense reviews.

Comments

No comments yet. Be the first to comment!

Related Templates

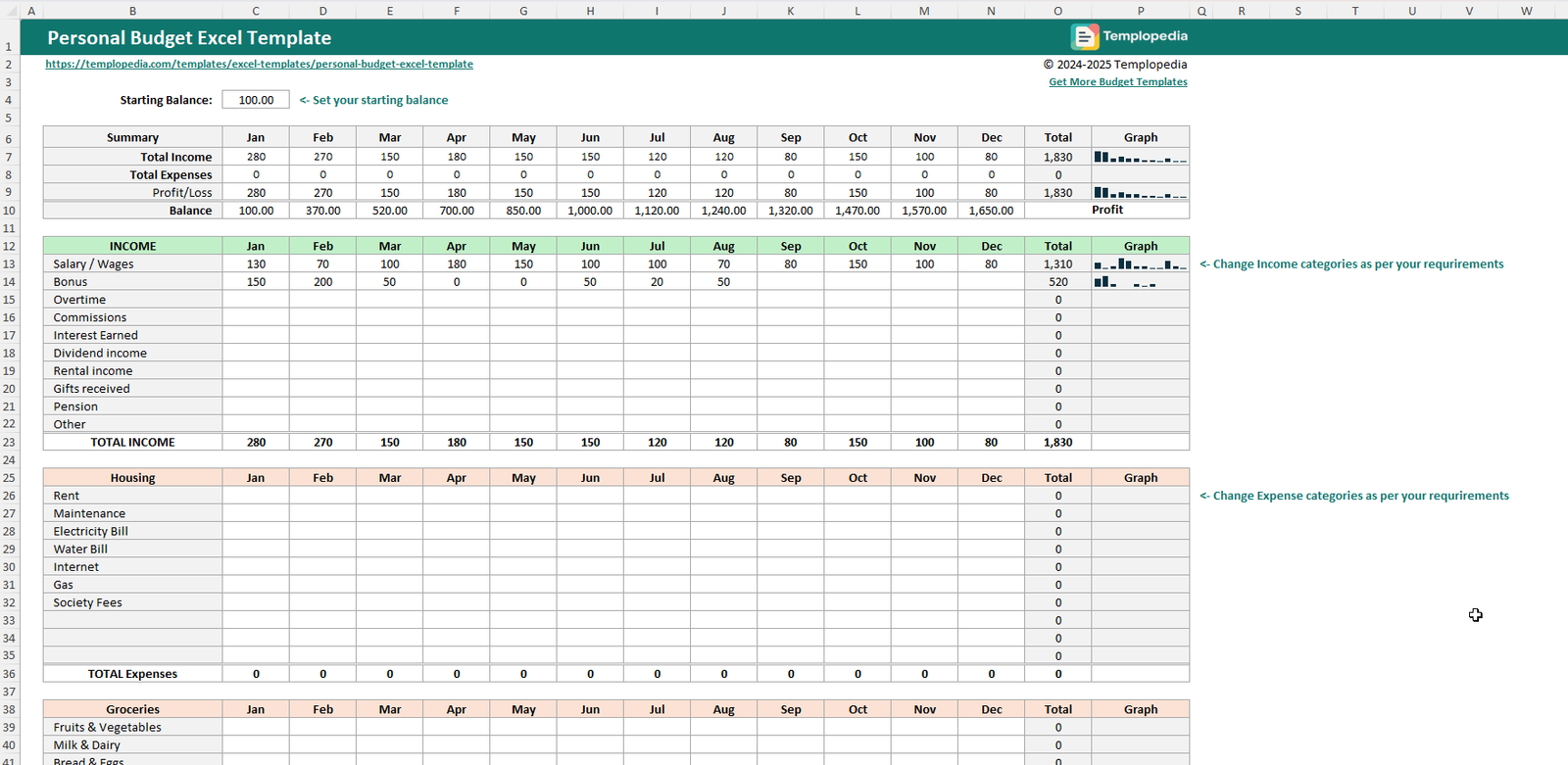

Personal Budget Excel Template

792 downloads

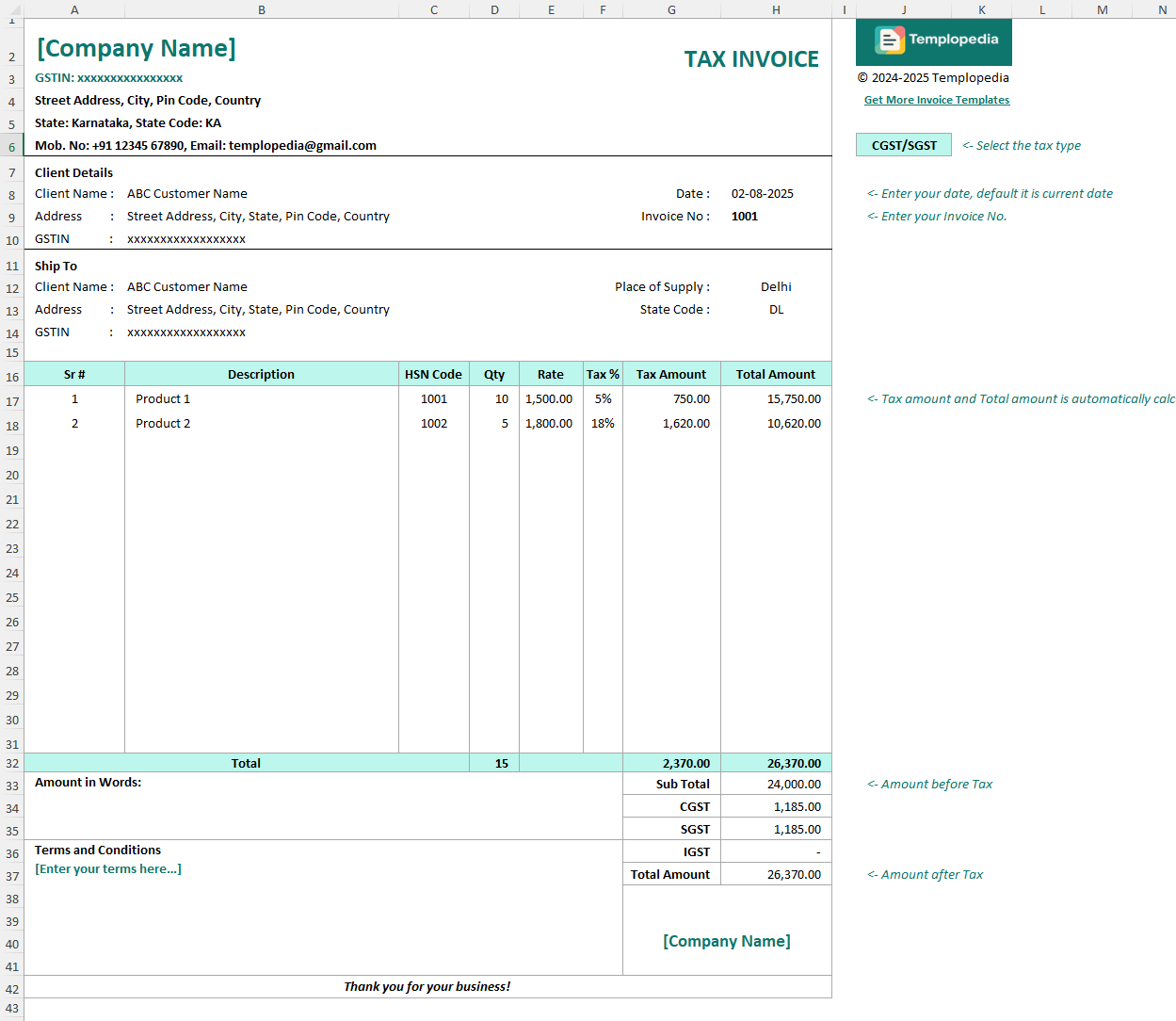

Free GST Invoice Template in Excel

696 downloads

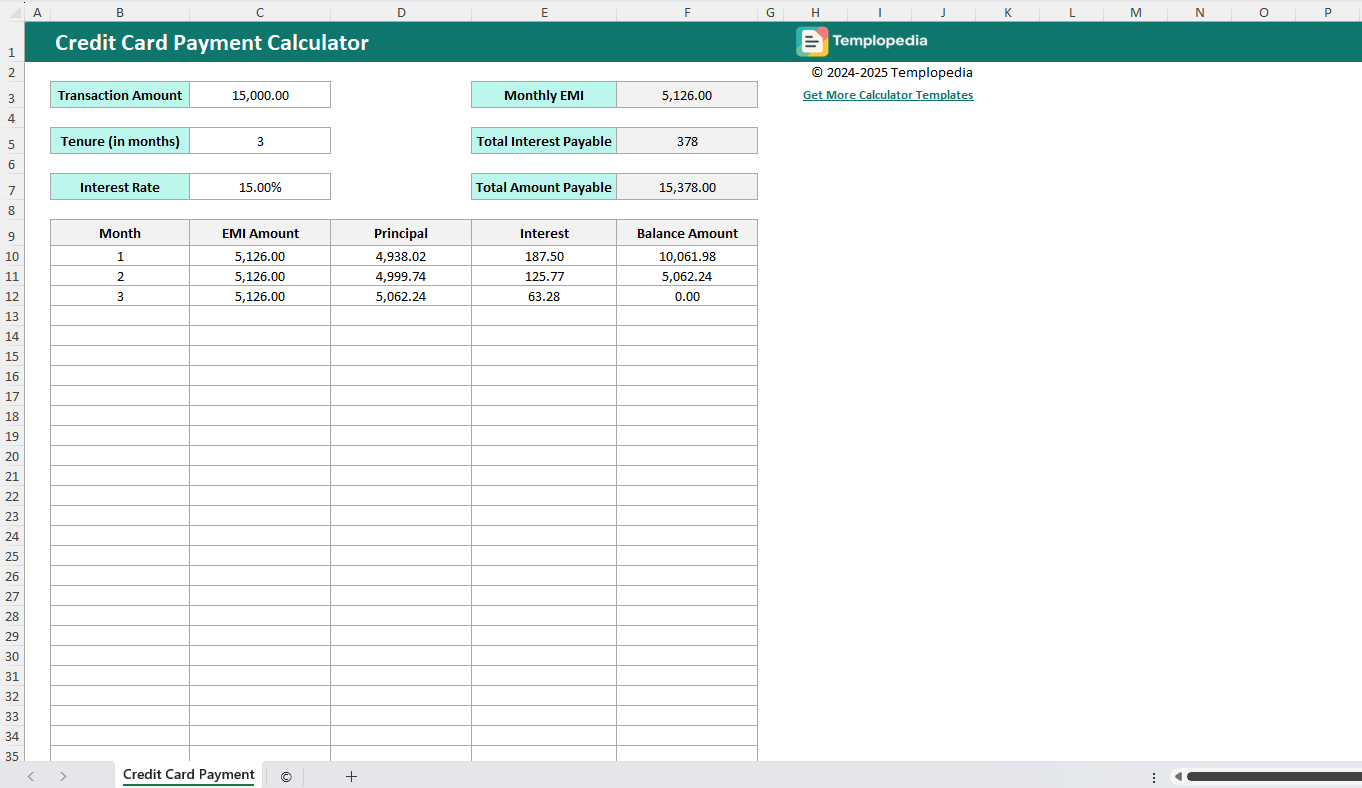

Credit Card Payment Calculator

28 downloads